- Start saving for their future: If the start of the ’23-’24 school year means you have one less child in daycare, take a portion of those dollars that were allocated to childcare and start saving for their future, today!

- Food Prep & Meal Planning: Summer camps are a wonderful way to have your children learn about the great outdoors. That experience often comes with quite an investment and a shift in your schedule – many times meaning take-out for dinner. Now that you are likely back to more of a routine schedule, food prep and meal planning are another great way to positively impact your budget and savings goals.

- Electrical usage: Was your front door a revolving door this summer? If you think about it, the cost to have multiple household members on their devices, cooling the house, and lights on in the house – all of these add up and can contribute to a larger electrical bill than normal. If you’re spending less time at your house during the fall months and if your electrical bill lowers, add those additional dollars into your rainy day fund.

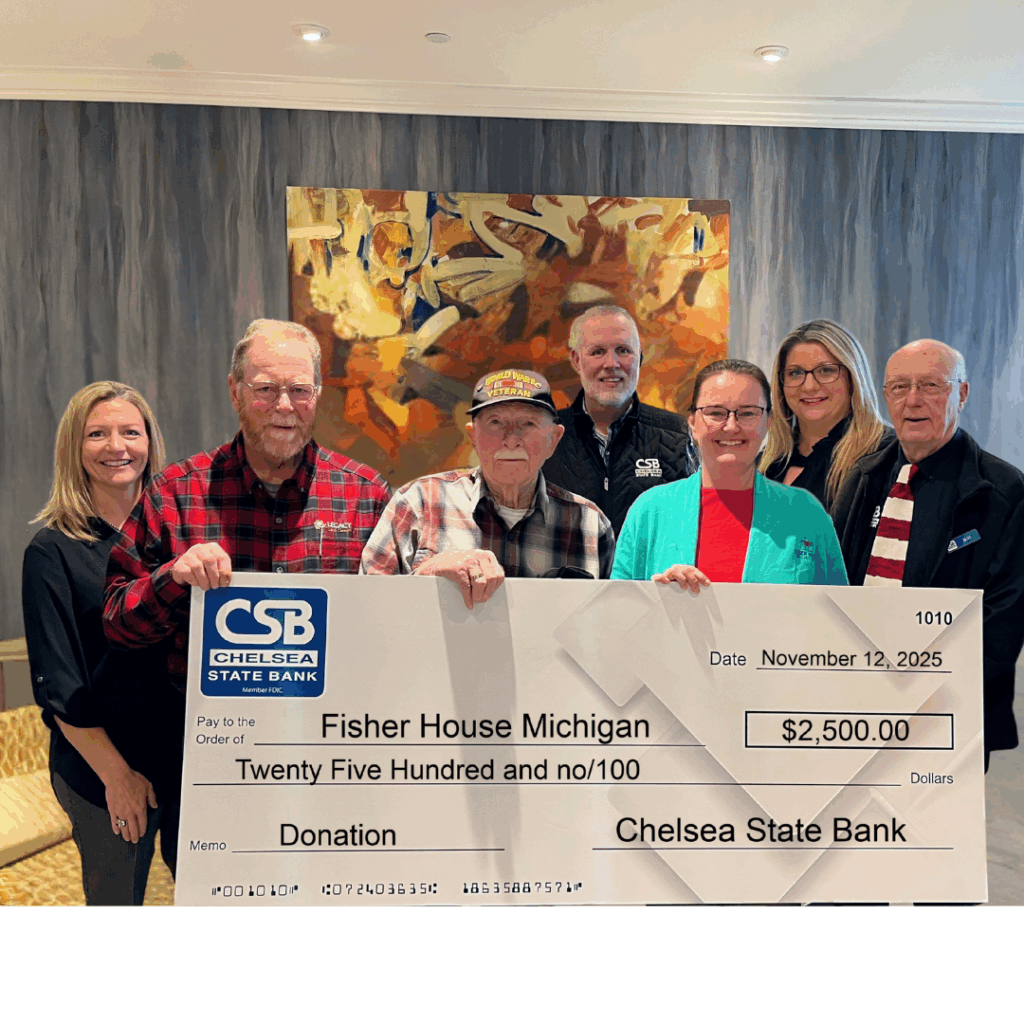

If you’re ready to have a conversation with one of our friendly and knowledgeable team members about other ways to make your money work for you – give us a call or stop into one of our locations, today!